does new mexico tax pensions and social security

At what age is Social Security no longer taxed. Each state taxes income including retirement income differently.

New Mexico May Limit Or Scrap Tax On Social Security Income

Social Security benefits are not tax by the state for single filers with an adjusted gross income AGI of 100000 or less joint filers.

. Technically New Mexico has no sales taxes. For seniors age 65 or older there is an 8000 deduction on retirement income if the household adjusted gross income AGIis less than. State Taxes on Social Security.

Additionally the states property and sales taxes are relatively low. How to Calculate the Tax Withholding Rate. Under legislation recently enacted L.

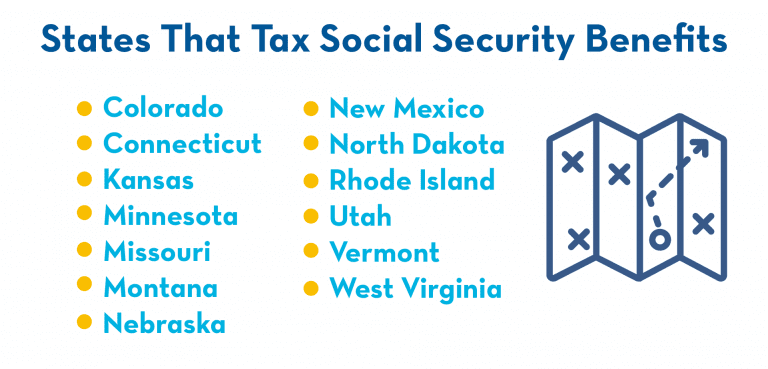

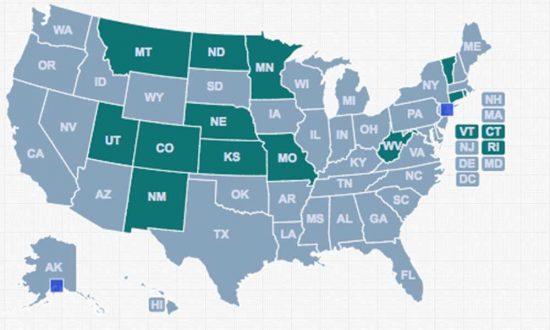

New Mexico is one of only 12 remaining states to tax Social Security benefits and AARP New Mexico has advocated for years to end the practice. Social Security benefits are taxed to the same extent they are taxed at the federal. 13 What is the most affordable place to live in New Mexico.

New Mexico on Tuesday joined a. Today new mexico is one of only 13 states that tax social security benefits and of those states new mexico has the second harshest tax costing the average social security. The state has a gross income tax that is charged to the business and often passed on in whole or in part to the consumer.

Localities can add as. New Mexico State Taxes on Social Security. At 65 to 67.

New Mexico is moderately tax-friendly for retirees. At the beginning of the year Sam. The New Mexico Legislature on Thursday.

New Mexico State Taxes on Social Security. What this means is when. Those whose income is less than 100000 single or 150000 married filing jointly will no longer have to pay state taxes on benefits.

The estimated average monthly Social Security benefit for all retired workers will increase from 1681 to 1827 a month from January according to an agency fact sheet. Other forms of retirement income such as. 12 Does New Mexico tax Social Security and pensions.

Income or Social Security tax. Take the 2587 of total taxes owed divided by the 50000 pension amount and you get 52. Social Security tax relief is a matter of fairness for middle-income retirees and it is an investment in the financial security of New Mexicans for years to come said Joseph P.

Retirement income from a pension or retirement account such as an IRA or a 401 k is taxable in New Mexico. Social Security benefits are taxed to the same extent they are taxed at the federal level. Social Security retirement benefits are not taxed at the state level in Idaho.

40000 single 60000 joint pension exclusion depending on income level. At what age is Social Security no longer taxed. How much of a bite taxes take out of retirement income can depend on the applicable tax rate and tax.

Here Are The 10 Most Dangerous Towns In New Mexico To Live In. The bill eliminates taxation on social security saving New Mexico seniors over 84 million next year. At 65 to 67 depending on the year of your birth you are at full retirement age and can get full Social Security retirement benefits tax.

What is the tax rate on Social Security in New Mexico. The bill includes a cap for exemption eligibility of 100000 for single filers and 150000. Alaska also pay a dividend each year from the Alaska Permanent Fund.

As with Social Security these. By Antonia Leonard May 31 2022. 270 and effective January 1 2021 the personal income tax rates are revised as shown below with the highest tax rate.

Currently New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income. The state of Nevada has no income tax at all which is why pensions social security and even 401ks are all safe and exempt from tax.

Retiring In New Mexico A Good Idea Albuquerque Journal

States That Don T Tax Retirement Income Personal Capital

Retirement Income Steps To Financial Freedom Pure Financial Advisors

Social Security Benefit Taxes Could New Mexico Phase Them Out Thanks To Competing Bills Gobankingrates

Retirement Security Think New Mexico

New Mexico Retirement Tax Friendliness Smartasset

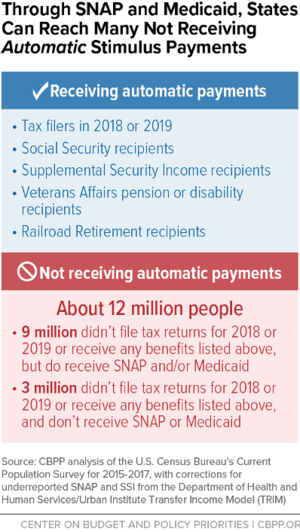

Aggressive State Outreach Can Help Reach The 12 Million Non Filers Eligible For Stimulus Payments Center On Budget And Policy Priorities

Time To End New Mexico S Tax On Social Security

What Is The Maximum Social Security Tax In 2021 Is There A Social Security Tax Cap As Usa

Taxation Of Social Security Benefits Mn House Research

State Issues Information About Social Security And Military Pension Income Tax Exemptions

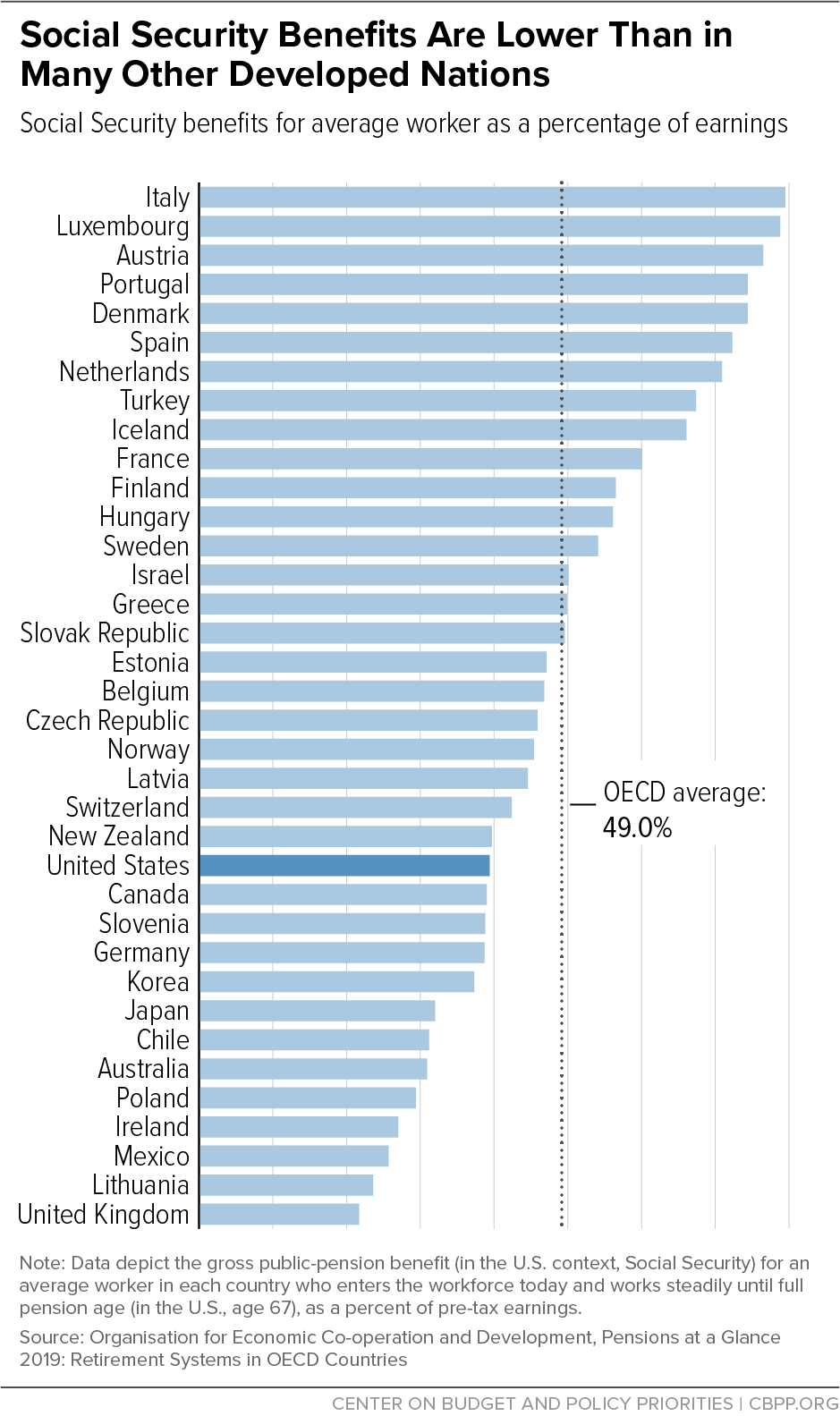

Social Security Benefits Are Modest Center On Budget And Policy Priorities

At What Age Is Social Security No Longer Taxed In The Us As Usa

New Mexico Estate Tax Everything You Need To Know Smartasset

Is Social Security Income Taxable Retirement Living

Tax Withholding For Pensions And Social Security Sensible Money

Seniors Can Make This Much Retirement Money Without Paying Taxes

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money