gilti high tax exception election statement

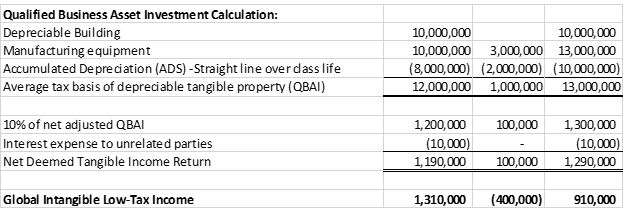

Final GILTI High-Tax Exception. Retroactive high-tax exclusion HTE election to exclude specific controlled foreign corporation gross income from being subject to the GILTI regime to the extent such gross income was.

High Tax Exception To Global Intangible Low Taxed Income 2020 Articles Resources Cla Cliftonlarsonallen

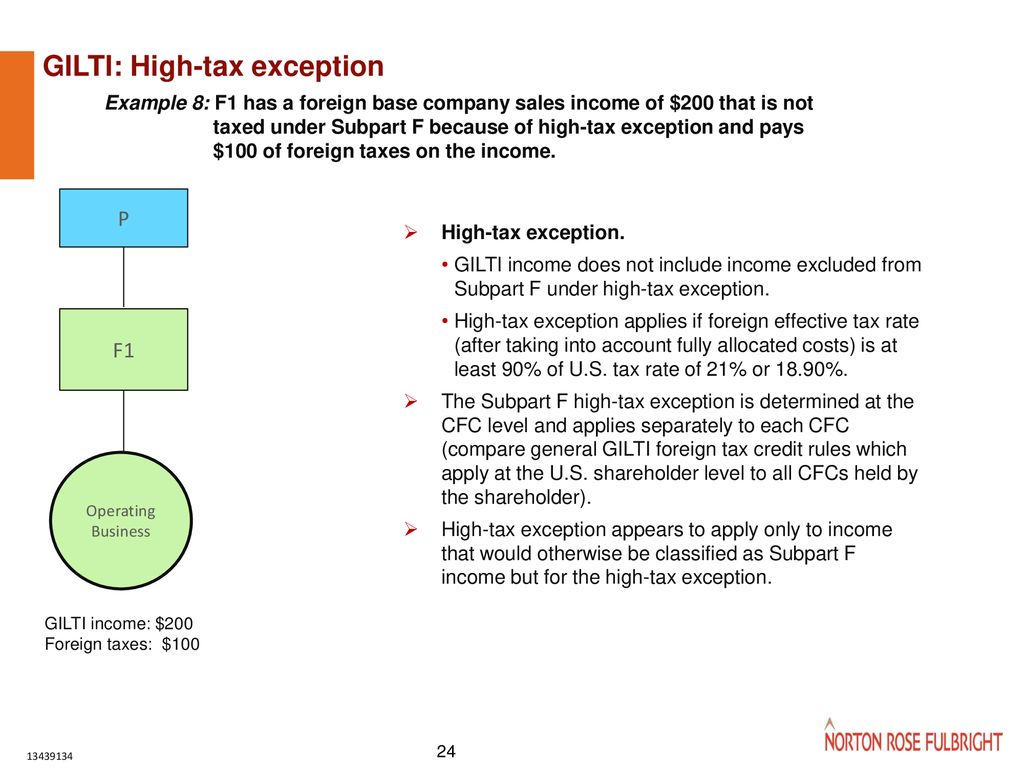

However the Final Regulations establish an elective exclusion for high-taxed CFC income that does not otherwise qualify for the Subpart F high-tax exclusion.

. Subpart f income but not. Report on Proposed and Final Regulations Addressing GILTI and Subpart F High-Tax Exceptions. The high-tax exception in Reg.

LoginAsk is here to help you access New Gilti Regulations quickly and handle each specific. The final regulations also give taxpayers the option of making a. The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020.

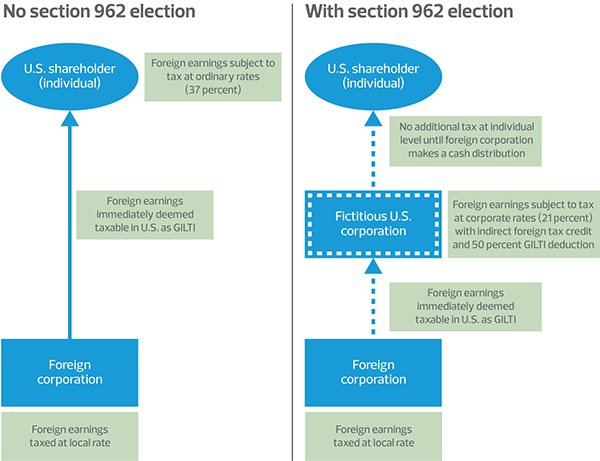

Shareholder of a controlled foreign. 9902 allowing taxpayers to exclude certain high-taxed income of a. In general 962 allows an.

The IRS issued the Global Intangible Low-Taxed Income GILTI high-tax exclusion final regulations on July 20 2020. Shareholder already recognizes as subpart f income and gross income excluded from subpart f due to the high. IRS Issues Guidance on GILTI High-Tax Exclusion.

Shareholder of a controlled foreign. Affirmatively elect to apply the high tax excep tion to exempt both subpart F under IRC 951 and GILTI inclusions Under IRC 951A from US federal income tax if the effective tax rate on. New Gilti Regulations will sometimes glitch and take you a long time to try different solutions.

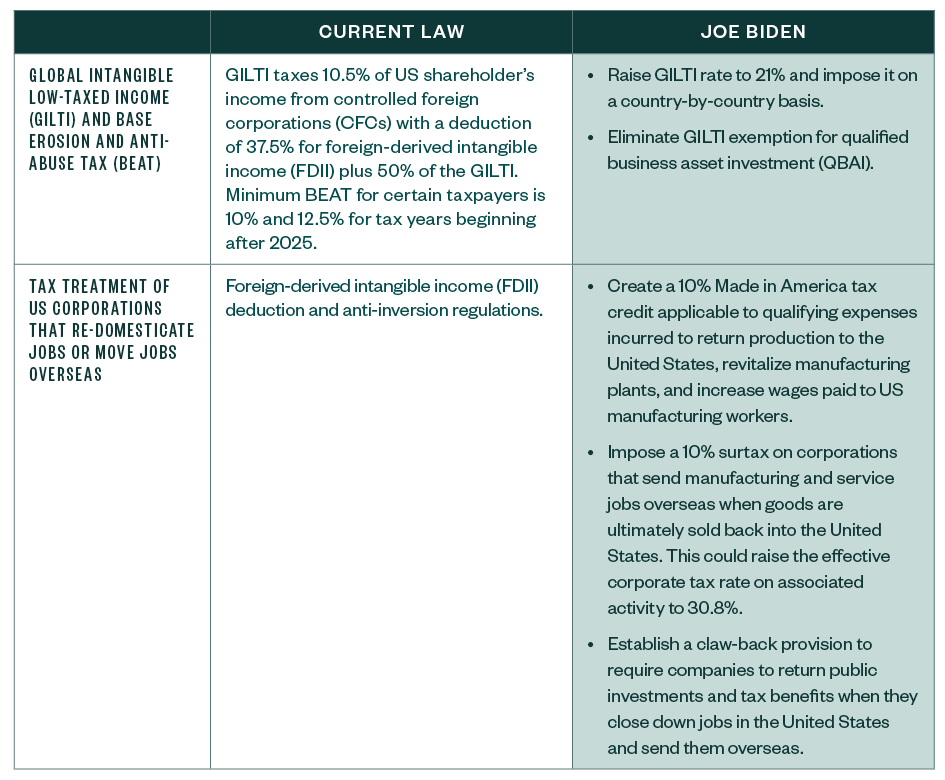

On July 23 2020 the Department of the Treasury. New Law Treats 95 of IRC section 951Aa GILTI Inclusion as Exempt Income under Corporation Franchise Tax Applicable for tax years beginning on or after January 1 2019 SB. Treasury Issues Final Regulations for GILTI High-Tax Exclusion and Proposed Regulations for Subpart F High-Tax Exception.

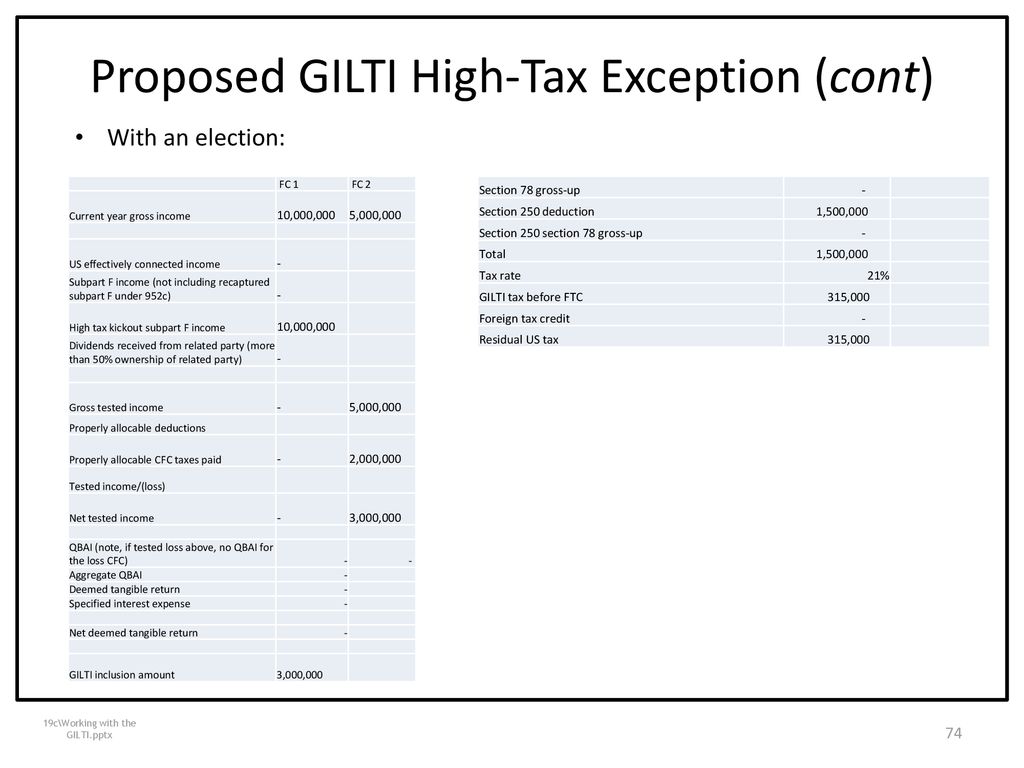

As a result a downside of the GILTI HTE election is that a HTE CFC that had high-tax foreign tax credits FTCs previously netted against GILTI liability would be excluded from the. Tax Section Report 1442. The Proposed Regulations adopt a unified election for subpart F and tested income that applies the rules of the GILTI High-Tax Exclusion for both tested income and subpart F income.

Treasury and IRS issued final regulations TD. Section 1951A-2c7viii provides that the GILTI HTE Election is made by the controlling domestic shareholder with respect to a CFC for a CFC inclusion year by filing the. With the introduction of the GILTI high-tax exception regulations taxpayers now have another strategy available that can be even more beneficial.

Report on Proposed Regulations Relating to a. Election The controlling domestic shareholders of the CFC make the election to use the GILTI high tax exception by attaching a statement to the shareholders federal tax. Gilti high tax exception election statement.

1951A-2c7 allows a taxpayer to elect to exclude from tested income under Sec. The GILTI high tax exclusion election is made by attaching a statement to a timely-filed income tax return.

Cushioning The Double Tax Blow The Section 962 Election

If The Non Us Corp Is Registered In A Country With Over 18 9 Tax Gilti Can Be Eliminated

Global Intangible Low Tax Income Working Example Executive Summary Mksh

Mcdermott S Take On Tax Reform

Guidance For Gilti High Tax Exception Forvis

Section 962 Election Of The Corporate Tax Rate By Individuals Trusts And Estates For Global Intangible Low Taxed Income Gilti Income Inclusions Thomas Ppt Download

International Aspects Of Tax Cuts And Jobs Act 2017 Ppt Download

Hard Hit On Global Supply Chain Structures Ppt Download

Gilti High Tax Exclusion How U S Shareholders Can Avoid The Negative Impact Sc H Group

Highlights Of The Final And Proposed Regulations On The Gilti High Tax Exclusion True Partners Consulting

A New Tax Regime For C F C S Who Is G I L T I Lexology

Gilti Regime Guidance Answers Many Questions

Harvard Yale Princeton Club Ppt Download

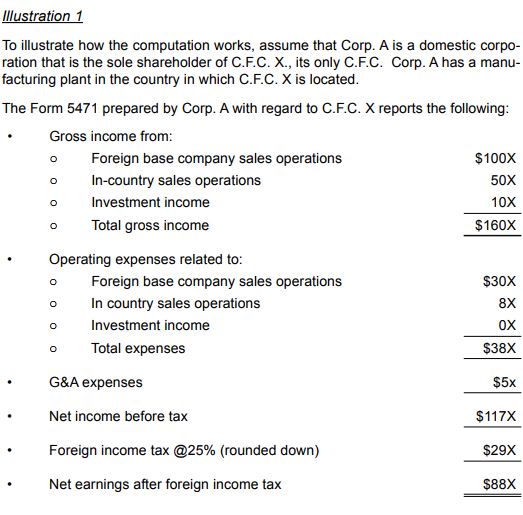

Instructions For Form 5471 01 2022 Internal Revenue Service

Worldwide Interest Expense Apportionment A Provision Worth Keeping

Latest International Tax Regulations Update Final Gilti High Tax And Fdii Youtube

Updates To Gilti High Tax Exception Regulations Henry Horne